What is the Transaction Success Rate?

Why is the Transaction Success Rate Important to Businesses?

Revenue Impact

A higher transaction success rate directly translates to more successful payments, which bolsters revenue and contributes to the financial health of the business. When transactions fail, potential sales are lost, leading to diminished profits and wasted marketing efforts. Additionally, consistent transaction failures can deter customers from returning, further impacting long-term revenue streams.

Customer Satisfaction

Smooth and reliable transactions are crucial for a positive customer experience. When the payment process is seamless, customers feel confident and satisfied with their purchase, which can lead to repeat business and word-of-mouth referrals. On the other hand, any failure during the payment process can frustrate customers, causing cart abandonment and eroding trust in the brand. Over time, this can damage the business’s reputation and decrease its customer base.

Operational Efficiency

Maintaining a high Transaction Success Rate (TSR) minimizes the time and resources required to address failed transactions. This efficiency allows customer service teams to focus on other important tasks, such as enhancing customer relationships and improving in-store product offerings. Moreover, fewer transaction issues mean that technical teams can allocate their time on system improvements rather than raising tickets to troubleshoot problems, thus fostering a more efficient and forward-thinking operational environment.

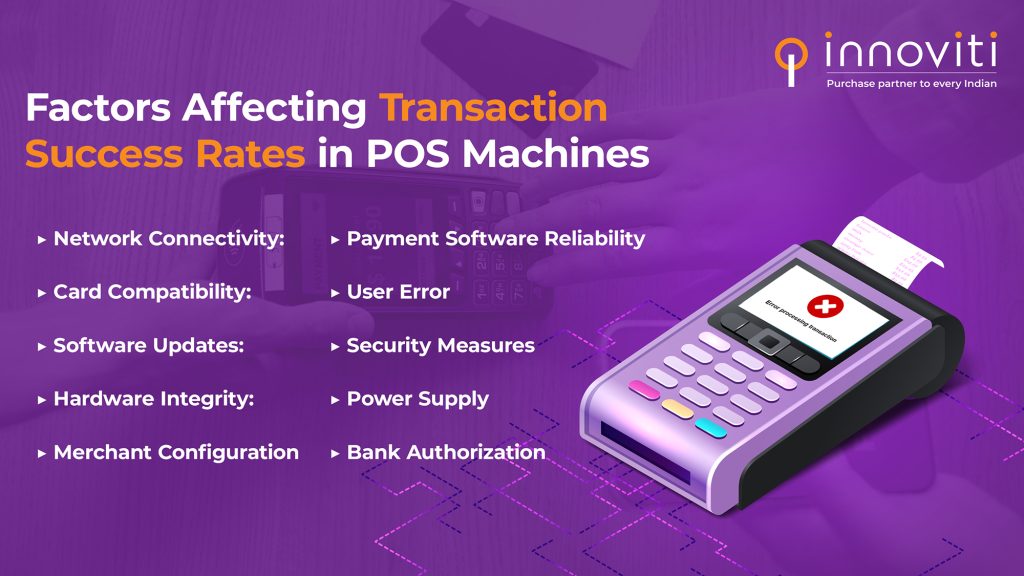

Factors Affecting Transaction Success Rates in POS Machines

Network Connectivity:

Reliable internet connection is crucial for the smooth functioning of POS machines. Poor connectivity can lead to transaction failures or delays. When the network signal is weak or unstable, the POS machine may struggle to communicate with the payment gateway and the issuing bank, resulting in interrupted or incomplete transactions. Ensuring a stable and strong internet connection, whether through wired or wireless means, is fundamental for consistent transaction success.

Card Compatibility:

The success rate can be affected by whether the POS machine supports various types of cards (e.g., credit, debit, contactless, chip, and magnetic stripe). Different cards use different technologies, and a POS machine must be equipped to handle all of them. For instance, newer cards may have contactless payment capabilities (NFC), while older ones may rely on magnetic stripes or chip-and-PIN systems. Ensuring that the POS terminal is updated to accept a wide range of card types can prevent transaction failures due to incompatibility.

Software Updates:

Regular updates to the POS system’s software ensure compatibility with the latest security protocols and transaction standards, reducing the risk of failures. Updated software can address previously discovered bugs, enhance system performance, and improve security measures. By keeping the POS software current, merchants can protect against vulnerabilities and ensure that the system operates efficiently with the latest banking and payment protocols.

Hardware Integrity:

The physical condition of the POS machine, including its card reader and stand, plays a significant role. Wear and tear can lead to errors during transactions. Damaged or dirty card readers can struggle to read the card’s data, causing transaction failures. Similarly, worn-out keypads in older POS models can make it difficult for customers to enter their PIN correctly. Regular maintenance and timely replacement of worn components can help maintain the POS machine’s reliability.

Merchant Configuration:

Proper setup and configuration of the POS machine by the merchant, including the correct input of terminal IDs and merchant accounts, are essential for seamless transactions. Incorrect setup can result in transactions being routed incorrectly or failing to process altogether. Merchants should ensure that all configurations are accurately entered and periodically reviewed to avoid any potential issues.

Payment Software Reliability:

The efficiency and reliability of the payment software being used in conjunction with the POS machine can impact the success rate. Frequent outages or slow processing times can lead to transaction issues. The payment software acts as an intermediary between the POS terminal and the issuing bank, so its performance is crucial. Choosing a reliable payment software provider with a strong track record of uptime and quick transaction processing can improve transaction success rates.

User Error:

Mistakes made by the cashier or customer, such as incorrect PIN entry or improper card insertion, can affect transaction success. User errors are common, especially in busy retail environments. Training staff on the correct use of POS machines and guiding customers through the payment process can minimize these errors. Clear on-screen instructions and audible prompts can also help reduce mistakes during transactions.

Security Measures:

The implementation of robust security measures, such as encryption and tokenization, helps in preventing fraud and ensuring transactions are processed successfully. Security protocols protect sensitive card information during the transaction process. Encryption ensures that data transmitted between the POS terminal and the payment gateway is secure, while tokenization replaces sensitive card details with a unique identifier, adding an extra layer of security. Adhering to industry security standards, like PCI DSS, is vital for protecting both the merchant and the customer.

Power Supply:

A consistent and reliable power supply is essential. Power fluctuations or outages can disrupt the transaction process. POS machines rely on a steady power source to function correctly. Power interruptions can cause machines to reboot or lose transaction data, leading to failed transactions. Using uninterruptible power supplies (UPS) and ensuring that power sources are stable can mitigate this risk.

Bank Authorization:

The ability of the POS machine to communicate effectively with the issuing bank for transaction authorization is crucial. Any interruptions or issues in this process can lead to declined transactions. The authorization process involves verifying the cardholder’s details and ensuring sufficient funds are available. If the communication between the POS terminal and the bank is disrupted, the transaction cannot be completed. Ensuring that the POS system has redundant communication pathways and robust networking can help maintain consistent authorization success.

Improving Transaction Success Rates in a Business Environment

Here are some strategies to enhance your transaction success rates:

- Choose Reliable Payment Software provider Investing in robust and reliable payment software provider is crucial for seamless transactions. Look for tools known for their high uptime, quick processing times, and strong security features. This will minimize transaction failures and ensure that customers can complete their purchases without interruptions.

- Optimize Network Connectivity Strong and reliable internet connections are essential for both online and offline transaction points. Ensure that all your transaction points at physical stores, have the necessary bandwidth and backup options to prevent downtime. Regularly monitor and upgrade your network infrastructure to handle increased traffic and avoid connectivity issues.

- Offer Multiple Payment Methods Catering to a diverse customer base means providing various payment options, such as UPI, credit/debit cards and EMIs. Seamlessly integrating these methods into your system will enhance customer satisfaction and reduce the likelihood of abandoned transactions. Additionally, keep up with emerging payment trends and technologies to offer the latest and most convenient options to your customers.

- Monitor and Adjust Fraud Detection Balancing security and customer experience is key. Regularly review and connect with your payment processor to know about the systems that are in place. Train your staff your staff to eliminate false positives that can frustrate legitimate customers. Focusing on these strategies can significantly improve their transaction success rates, leading to higher customer satisfaction and increased revenue.

The Role of Innoviti Technologies in Improving Transaction Success Rates

Jagan, the owner of a thriving grocery chain, faced a major challenge with payment failures. Before integrating Innoviti uniPAYNext, his stores had an 85% transaction success rate, resulting in 300 failed transactions each month. These issues frustrated customers and disrupted operations.

After implementing uniPAYNext, Jagan’s transaction success rate soared to 99.6%, reducing failed transactions to just 8 per month. This improvement has significantly enhanced customer satisfaction and streamlined operations, allowing Jagan to focus on growing his business.

By utilizing uniPAYNext, Jagan has not only significantly improved his transaction success rate but also greatly enhanced customer satisfaction. This seamless payment experience has resulted in happier customers who are more likely to return. Additionally, the reduction in payment issues has streamlined his operational processes, leading to increased revenue and less time spent dealing with transaction problems. Overall, adopting uniPAYNext has allowed Jagan to focus more on growing his business and less on mitigating operational headaches.