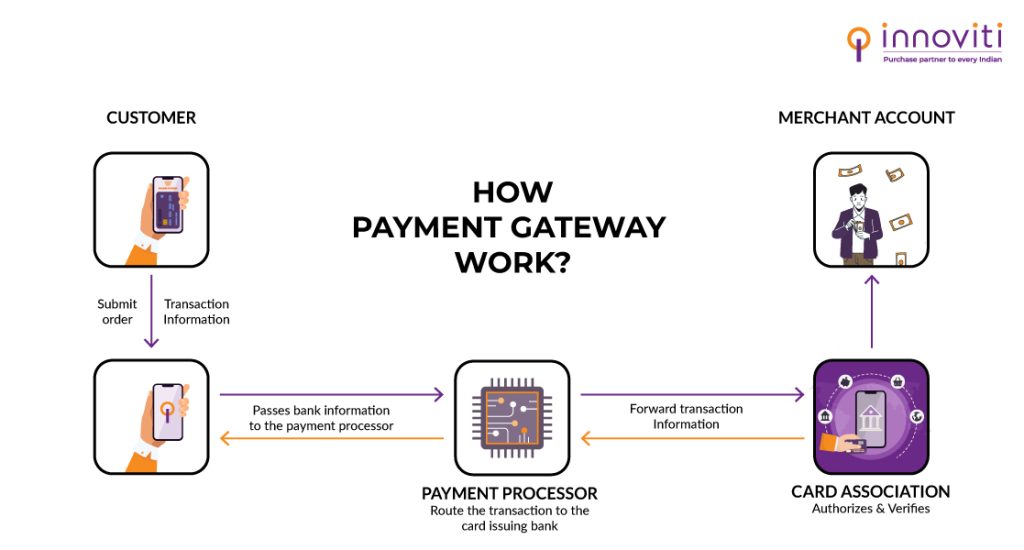

What is a Payment Gateway?

A payment gateway is a payment processing software. Payment gateways only deal with online transactions and are equipped with restricted payment options. Examples of payment gateways include Axis bank, HDFC, Union Bank of India, etc., as in India, most banks act as payment gateways.

What is a Payment Aggregator?

Under the payment aggregator model, merchants can process transactions through the aggregator’s Merchant Identification Number (MID). This means your business doesn’t require a separate merchant account as the payment aggregator takes care of everything while levying a moderate fee.

Innoviti is one of the finest examples of payment aggregators, as it recently received an in-principle permit from the RBI to act as one. It is to be noted that payment aggregators can act as payment gateways, but payment gateways need not offer the wide range of services which payment aggregators do”.

Difference Between Payment Aggregator and Payment Gateway

Let’s look into the simple comparison that will tell you the exact difference. While a payment gateway is an intermediary, the payment aggregator is the interface where the payment gateway processes the transactions. Most payment aggregators own payment gateways to offer a variety of exclusive services to their merchant customers. Check out Innoviti, India’s largest collaborative e-commerce platform, and your trusted payment aggregator. Explore our various products and choose the right one for your business needs now!

Advantages of Payment Aggregators for Businesses

Quick Setup:

Payment aggregators typically offer a straightforward and quick setup process, allowing businesses to start accepting payments online rapidly.

Easy Integration:

Integration with payment aggregators is often user-friendly and doesn’t require extensive technical knowledge. This ease of integration can save businesses time and resources.

Reduced Compliance Burden:

Payment aggregators handle many of the regulatory and compliance requirements, simplifying the process for businesses. This can be especially beneficial for smaller merchants who may find compliance procedures complex.

Aggregated Merchant Accounts:

Payment aggregators operate by aggregating multiple merchants under a single merchant account. This shared infrastructure reduces administrative overhead and makes it easier for small and medium-sized businesses to get started with online payments.

Faster Onboarding:

The onboarding process for merchants is typically faster with payment aggregators compared to traditional merchant account setups. This speed is crucial for businesses looking to quickly establish an online presence.

Cost-Effective for Small Businesses:

Payment aggregators often have lower upfront costs and may not require a long-term commitment, making them cost-effective for small businesses and startups that may not have the financial resources for a traditional merchant account.

Access to Multiple Payment Methods:

Payment aggregators usually support various payment methods, including credit/debit cards, digital wallets, and other online payment options. This flexibility enables businesses to cater to a broader range of customer preferences.

Unified Dashboard:

Many payment aggregators provide a unified dashboard that allows businesses to manage transactions, view analytics, and access other relevant data in one central location. This simplifies the overall payment management process.

Risk Management:

Payment aggregators often include built-in risk management tools to help identify and mitigate fraud. This added layer of security can be beneficial for businesses concerned about online payment risks.

Scalability:

As businesses grow, payment aggregators can often scale with them, accommodating increased transaction volumes and additional features to meet evolving needs.

Payment Aggregator vs Payment Gateway

While your business needs both payment services to function properly, here are some of the subtle differences between payment aggregator and payment gateway. Check out the given table to get a clear understanding of the differences.

Scope Both online/offline transactions only online transactions

| Basis of Distinction | Payment Aggregator | Payment Gateway |

| Primary Function | Acts as an interface | Acts as intermediary |

| Multiple Payment Options | Yes | No. limited payment options |

| Owned By | Generally, ownership lies with fintech companies and financial service providers | Banks, vendors, payment aggregators, etc. |

| Authorization | Payment Card Industry – Data Security Standard (PCI DSS) certification | RBI authorization under PSSA is required |

| Examples | Innoviti, Bill Desk, PayUMoney, etc. | HDFC, ICICI, Axis banks, Razorpay etc. |

| Integrated Solution | Full integration is available here | Relatively less integration compared to aggregators |

Conclusion

With Innoviti, merchants can sign up for industry grade services. Experience faster online and credit card payment acceptance with minimal fuss and give your customers the seamless and secure shopping experience they deserve now!

Frequently Asked Questions

Of the many advantages, minimal paperwork, easy application process, speedy approvals, instant payment acceptance, no complicated fee structure, are some that compel merchants to seek out dedicated merchant aggregators.

There are three types of payment gateways such as

- Hosted Payment Gateways

- Self-Hosted or Pro-Hosted Payment Gateways

- API Hosted Payment Gateways

Before choosing the right payment gateway based on your business requirements, consider various factors such as security, compliances, data analytics, integration level, and more, before arriving at a suitable one for increased business growth and happy customers.

According to TOI, the top and best payment gateways in India include Innoviti, Razorpay, Instamojo, Paypal, Paytm, and Cashfree.

For offering the payment gateway processing services, your service provider charges a fee. The different components of payment gateway charges comprise initial setup charges, yearly maintenance charges, MDR, integration charges for your online website and gateway integration, etc.